According to our latest analysis of Australian financial planning firms, (Future Ready VIII, Jan 2020), 55% of clients are aged 60+, while 45% are now retired.

The baby boomer generation is finally greying and is today faced with grown-up children, growing up grandchildren and their own ‘once indestructible’ parents. Interests and needs are slowly and surely changing across so many sectors of our society. And when their estate eventually passes to the children, there’s no guarantee that the adviser who has helped to create the estate, will remain a part of their plans going forward. In fact, various research suggests that as many as two out of every three children will terminate their parent’s adviser soon after the inheritance passes – for no reason other than that they don’t perceive that they have a relationship with mum and dad’s adviser.

Our analysis further tells us that older clients are now beginning to question the need for the level of ongoing fees they’re being asked to pay. It’s against this backdrop, that, somewhat alarmingly, ‘Range of Services’ has slipped to be the third lowest rated of the nine KPIs measured by our CATScan client survey. Clients are today looking for more than accumulation and protection advice from their adviser it seems!

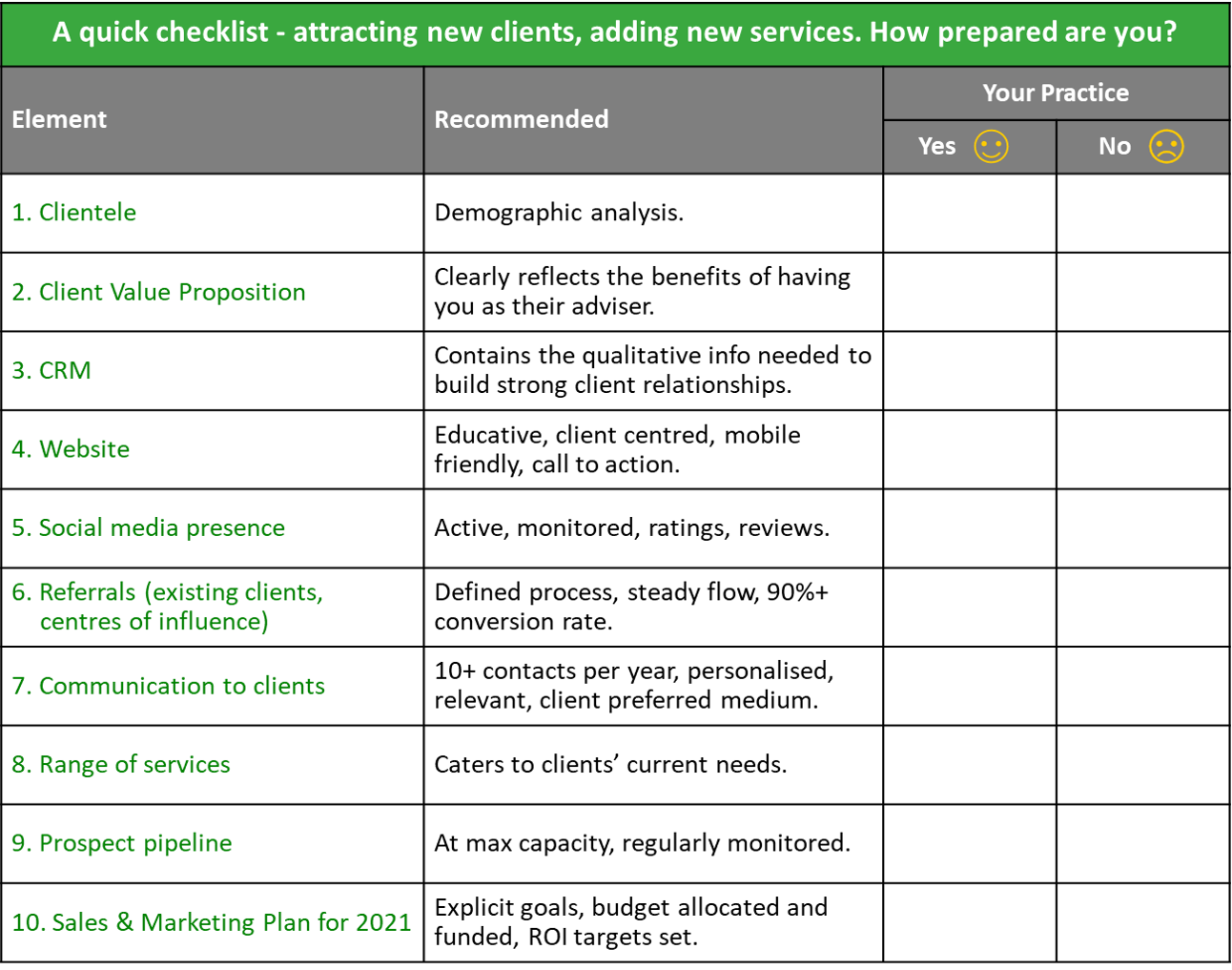

Faced with the above scenario, we believe that expanding the current offer and capability of the firm (so that it can cater for aged care, estate planning, healthcare and philanthropy for example) will emerge as a key imperative for many in 2021. In which case, maybe our Checklist will prove of interest:

For your consideration.