HEARING WHAT’S UNSAID (3)

…understanding what your clients may not be telling you

This article is the third in a series of Business Health insight pieces drawn from the most recent analysis of our CATScan Client Satisfaction Survey data.

The CATScan dataset now contains feedback from over 45,000 Australian clients, all of whom are using the services of a financial adviser. As such, these findings are unique in the Australian advice marketplace and exclusive to Business Health. We hope you find them of interest and value as you build out your plans for 2021 and beyond.

It’s all new for new clients

It is often said that within the first seven seconds of meeting, people will form a solid impression of who you are and start to determine traits like trustworthiness. While this is a truly scary statistic and one all advisers need to be extremely mindful of, it is also worth extrapolating this timeframe out a little and considering how new clients are onboarded and integrated into your business.

This becomes especially important if your practice has a growth focus and you are looking to increase the number of clients you serve. Interestingly, our CATScan Client Satisfaction Survey data shows that in the average Australian advisory business, 55% of clients are aged over 60 and 48% are already retired or no longer gainfully employed – for many firms, new client acquisition will be high on their priority list as they address the challenges of an aging client demographic.

As we thought this through, we were initially not that concerned – after all, the satisfaction levels of your new clients should be through the roof, right? These clients have just been through your full fact find process and shared with you their most treasured dreams and aspirations for themselves and their family. Perhaps for the first time ever, they have also revealed their inner most fears and concerns for the future. They have confided in you, things they may not have disclosed to any other professional, and maybe not even to those closest to them. And they have decided on you!

You have then taken all of this intensely personal information and using all of your experience, training and expertise, put forward a solution that, all going to plan (excuse the pun!), will deliver the desired outcomes while protecting against the most significant downside risks.

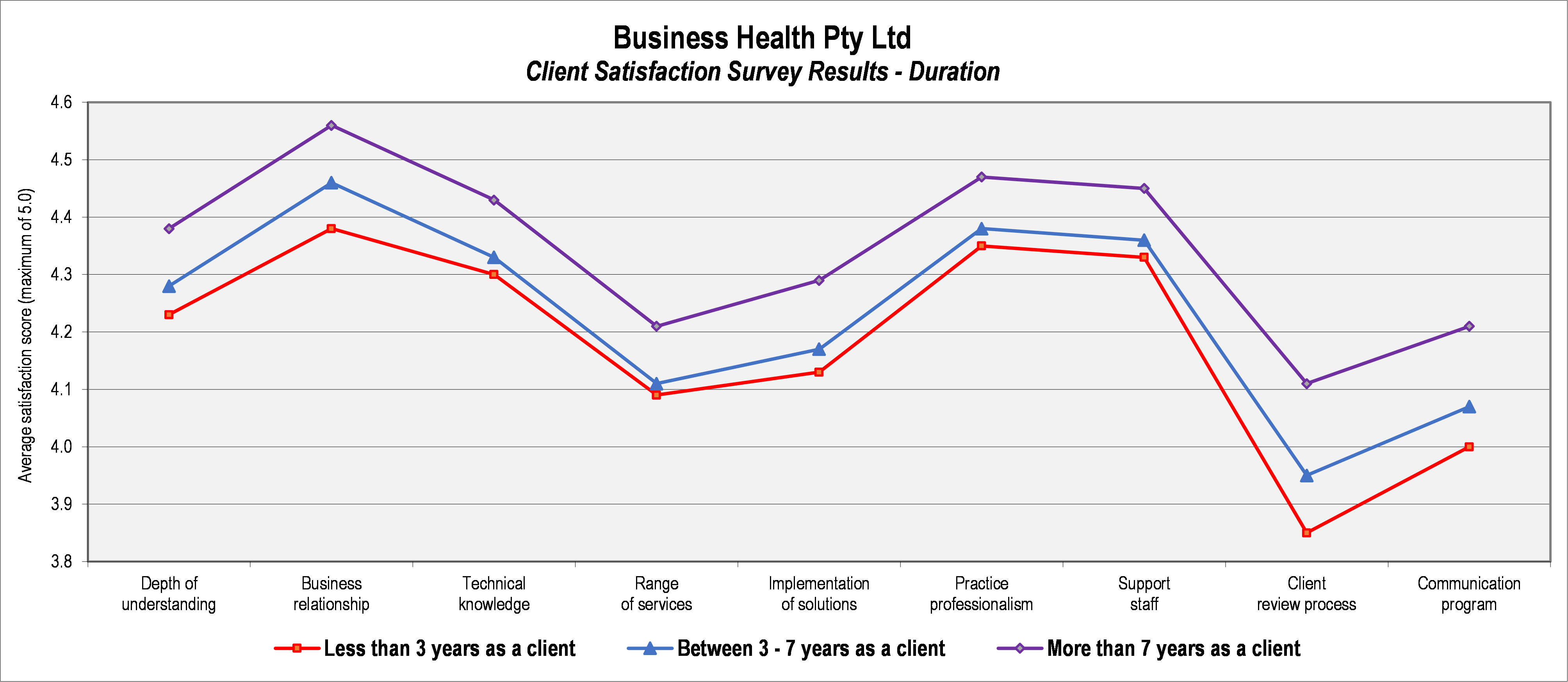

However, as we all know, a cold hard analysis of the facts will always trump assumptions based on intuition or gut feel. Unfortunately, our most recent CATScan analysis provides a healthy dose of sobering realism. The following chart plots the satisfaction levels of new clients versus those that have working with their adviser for longer periods of time.

It clearly shows that the new clients are less satisfied with their adviser’s performance across all nine of the key service delivery areas covered in the CATScan survey (and remember, this is based on over 45,000 “real” clients currently using the services of an Australian adviser).

So, what does this mean for your business? Before anyone (including you) can answer this, you need to honestly and objectively understand just how your new clients would rate their experiences to date and how this might compare to the satisfaction levels of your longer term clients.

As you contemplate this, we hope the following insights drawn from our 20+ years of experience helping advisers understand and interpret their own CATScan survey results might provide a little more context.

1. The first impression

When a client first comes onboard for example, what happens in your firm? What’s the client’s first impression? If they feel ‘good’, ‘confident’ or better still ‘delighted’ by their choice, then you’re on the right track. But if they don’t feel this way or, perhaps worse, you don’t actually know, it’s time to get proactive.

A few tips from some advisers we’ve recently worked with about how they create you’re their distinctive “vibe”:

- Actively seek client’s feedback on what they liked and didn’t like about their onboarding experience and, ask for their suggestions on how your process could possibly be improved. Remember, this is all about them, not their adviser or his or her practice.

- Does your ‘welcome to our practice’ pack make them feel special? Perhaps include a handwritten note from the person who will be servicing the client, introducing themselves and explaining how they can work together to ensure the ‘best’ experience? Or, how about including a lifestyle questionnaire asking how your client likes to celebrate birthdays, favourite food, favourite sports teams, communities they’re a member of, red or white wine, music preferences etc?

- And as the relationship evolves over time, perhaps the most important driver of client satisfaction is… communication. It’s frequency, relevance and level of personalisation all play major roles in keeping clients in the loop, aware and, hopefully, appreciative of their adviser’s efforts.

2. What’s the client expecting (from you)?

Except in a few very rare and isolated cases, advisers who underperform in this area are not generally providing poor service to their new clients. Rather, they have usually failed to explicitly set and manage their new clients’ service delivery expectations.

When left to their own devices (and not knowing any better), new clients will expect the world and demand it yesterday. If you do not take a very active role in clearly defining exactly what you will do and by when, you are setting yourself up to fail. No matter how good your work, or how quickly you deliver, it will almost always underwhelm your new client’s set of self determined and completely unrealistic expectations.

To minimise the chances of this happening to you, ensure you follow up every meaningful client contact in writing. Clients can sometimes forget the full detail of your discussions so every time you commit to do something, confirm the what, who and when in an email.

Also cut yourself (or at the very least your team) some slack. When committing to timeframes, buy yourself a little time. Unless it is an especially time critical task, add a day or two to the delivery date. By under promising and over delivering you will not just meet, but consistently exceed the well managed expectations of your new clients.

3. Remind me – what do you do (again)?

We have no doubt that, in some way, shape or form, all advisers explain to their new clients all of the different ways in which they can add value. However, it is also completely understandable that most of your new clients are almost singular focussed on solving their immediate need – they may not be that interested in your other services that are not directly applicable to their current situation.

While this is completely understandable, the analysis chart above proves that providing your new clients with a once only FSG that contains a long list of product names, or creating a services tab on your website, may not permanently burn your full service offer into the frontal cortex of their brain.

You need to continually educate your clients on the depth and breadth of your solution suite. This includes not just solutions you directly deliver, but also any ancillary services you can facilitate through your strategic alliance network. This will ensure that you and your firm remain the “go to” solution for whatever changes life throws at any of your clients.

If new client acquisition is part of your plans for the year ahead and you are interested to know the satisfaction levels of your new clients and how this compares to your other clients, or indeed the marketplace at large, please let us know. We have a wealth of experience helping advisory firms better understand what their clients think of the services they are receiving.

For your consideration.